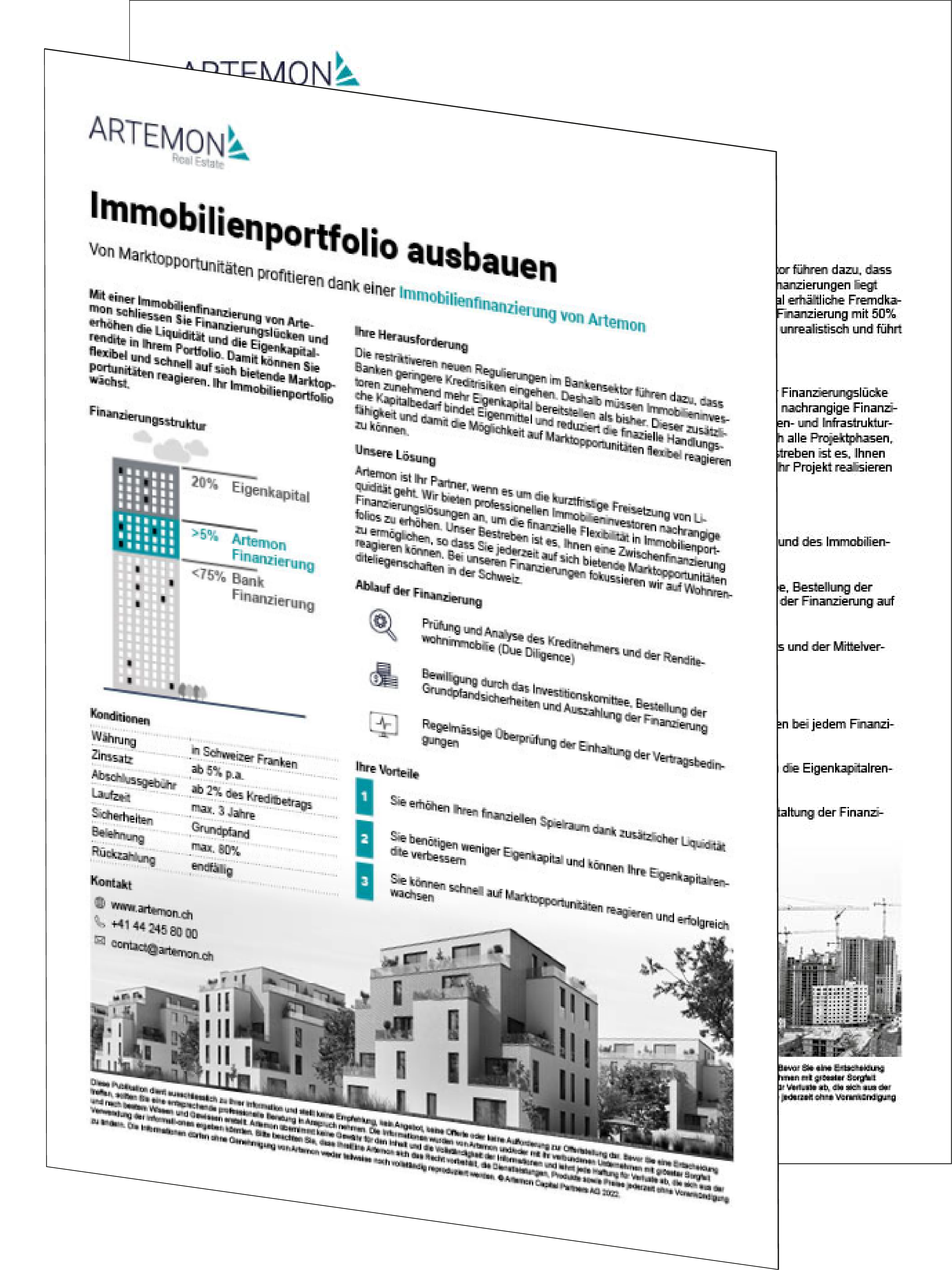

Optimisation of the capital structure

The efficient use of equity increases the return.

Strengthening your real estate portfolio

Traditional lenders are becoming increasingly restrictive in granting loans. This creates funding gaps that real estate investors can close with subordinated financing. Such financing optimises the capital structure and frees up liquidity for new market opportunities.

Artemon arranges subordinated loans with the following terms:

Loans upwards of CHF 1.0 million

Maximum loan-to-value ratio of 80% (LTV)

Maturity of up to 4 years

All loans are secured by mortgages

Focus on residential properties

Financing is provided exclusively by the Daneo Swiss Residential Property Debt Fund.

The efficient use of equity increases the return.

The release of liquidity increases economic possibilities.

Rapidly seizing new market opportunities.

Get more information on how to increase your financial flexibility and successfully grow your real estate portfolio.